COMPLIANCE REQUIREMENTS & BUSINESS STRUCTURES IN MALAYSIA

1. Comparison of Difference Type of Business Structure in Malaysia

| Sole proprietorship (“Enterprise”) | General partnership (“Enterprise”) | Limited Liability Partnership (“LLP”) | Public Company (“Bhd”) | Private Limited Company (“Sdn Bhd”) | |

|---|---|---|---|---|---|

| Owned By | 1 person | 2 – 20 partners | ≥ 2 partners | ≥ 2 person | 1 – 50 persons |

| Legal Limited Liability | No | No | Yes | Yes | Yes |

| Tax Liability | Taxed at owner’s personal tax rates | Taxed at partners’ personal tax rates | Taxed at partner’s personal tax rate (if individual); corporate tax rate (if corporation) | Taxed at corporate tax rate. 24% | Taxed at corporate tax rate. Low paid-up capital: 17 – 24% High paid-up capital : 24% |

| Owning of Property | Can | Cannot | Can | Can | Can |

| Minimum Registration Requirements | Owner* must be Malaysia citizen or permanent resident. | Owner* must be Malaysia citizen or permanent resident. | Partners can be individuals* or body corporate (Company or LLP) | 1 local resident Director* + 1 local resident secretary + 1 local/ foreign shareholder* or corporate shareholder | 1 local resident Director* + 1 local resident secretary + 1 local/ foreign shareholder* or corporate shareholder |

| Audit requirement | No | No | No | Yes | Yes, some Company may qualify for exemption. |

| Yearly statutory obligation | Yearly renewal of Business Registration | Yearly renewal of Business Registration | Annual Declaration of Solvency or Insolvency | Annual Return filing | Annual Return filing |

*The person must be at least 18 years old or above.

2. Foreign Company Setup Options in Malaysia

| Subsidiary Company | Branch Office | Representative Office | Regional Office | |

|---|---|---|---|---|

| Entity Name | Need not be the same as parent company | Must be the same as parent company | Must be the same as parent company | Must be the same as parent company |

| Allowed activities | Can conduct all business activities | Must be the same as the parent company | Can only conduct market research or coordinating activities | Serve as the coordination centre and designated activities for the company’s affiliates, subsidiaries and agents in South-East Asia and the Asia Pacific regions |

| Suitable for | Long term | Short term | Short term | Short term |

| Ownership | May be 100% owned | 100% owned by head office | No ownership | No ownership |

| Legal Limited Liability | Yes | No, Liabilities extend to parent company | No, Liabilities extend to parent company | No, Liabilities extend to parent company |

| Tax benefits | Available | Not available | Not applicable | Not applicable |

| Minimum Registration Requirements | 1 local resident Director* + 1 local resident secretary + 1 local/ foreign shareholder* or corporate shareholder | At least 1 person residing in Malaysia to be its authorised agent in Malaysia | Proposed operational expenditure must be at least RM 300,000 per annum and must completely funded by the (foreign) parent Company. | Proposed operational expenditure must be at least RM 300,000 per annum and must completely funded by the (foreign) parent Company. |

| Yearly statutory obligation | Lodgement of audited financial statement of subsidiary to SSM and filing of annual return | Lodgement of audited financial statement of branch and parent company to SSM and filing of annual return | Not applicable | Not applicable |

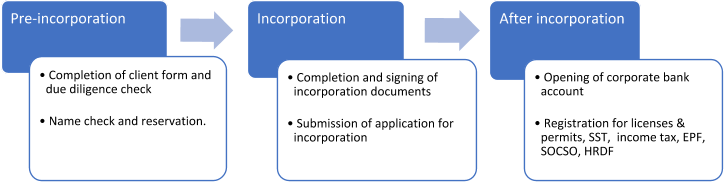

3. How do I go about to register a Company/ Business.

4. What information and documents do I need to submit to register a Company / Business?

- 3 Proposed Company name;

- Business Activities;

- Share Capital details;

- How many shares

- $ per share

- Registered Office Address;

- Director(s)’s details:

- Name

- NRIC/ Passport

- Contact number

- Email address

- Shareholder(s)’s details:

- Name

- NRIC/ Passport

- Contact number

- Email address

- Number of shares and percentages of shareholding

- Financial Year End (FYE)

- 3 Proposed Business name;

- Business Activities;

- Registered Office Address

- Partner’s details:

- Individual

- Name

- NRIC/ Passport

- Contact number

- Email address

- Corporate

- Corporate Name

- Business/ Company’s registration number

- Corporate representative’s name, contact number and email address

- Individual

- 3 Proposed Business name;

- Business Activities;

- Registered Office Address;

- Owner’s details:

- Individual

- Name

- NRIC/ Passport

- Contact number

- Email address

- Individual

- Clear certified copy of MyKad (front & back)

- Clear certified copy of MyKad (front & back)

- Clear certified copy of Passport bearing photograph, personal details and expiry date (please include address page, if any)

- Clear certified copy of Passport bearing photograph, personal details and expiry date (please include address page, if any)

- Clear certified copy of Employment Pass/ Work Permit (front & back)

- Original or a clear certified copy of address proof (i.e. bank statement/ utility bill) not later than 3 months, bearing the name and residential address (if residential address does not show in employment pass/ work permit)

- Clear certified copy of Passport bearing photograph, personal details and expiry date (please include address page, if any)

- Address proof not later than 3 months, bearing the name and residential address (i.e. bank statement/ utility bill)

- Original or a clear certified copy of address proof (i.e. bank statement/ utility bill) not later than 3 months, bearing the name and residential address

- Certificate of Incorporation

- Business Profile / Certificate of Incumbency (or equivalent documents)

- Registers of Directors and Members

- Memorandum and Articles of Associations / Constitution / Bye-Laws (or equivalent documents)

- Group structure chart (for multi-tier company structure)

- Directors’ Resolutions or Power of Attorney authorising the incorporation of Malaysia company.

Important Notes:

- All copies shall be certified by either notary public, lawyer or YTK personnel. The certifier is required to sign on the document(s) and state details of the certifier, i.e. full name, designation, company name/stamp and date of certification.

- YTK reserves the right to request for supporting documents and/or information in relation to the source of funds / wealth of the Ultimate Beneficial Owner(s) and/or shareholder(s).

5. What do I need to know about setting up a Company/ Business?

| Company Structure (minimum requirement) |

| ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Share Capital | Minimum RM1 To qualify for the work permit application for foreign employee, the Company must fulfil: –

| ||||||||||||||||||

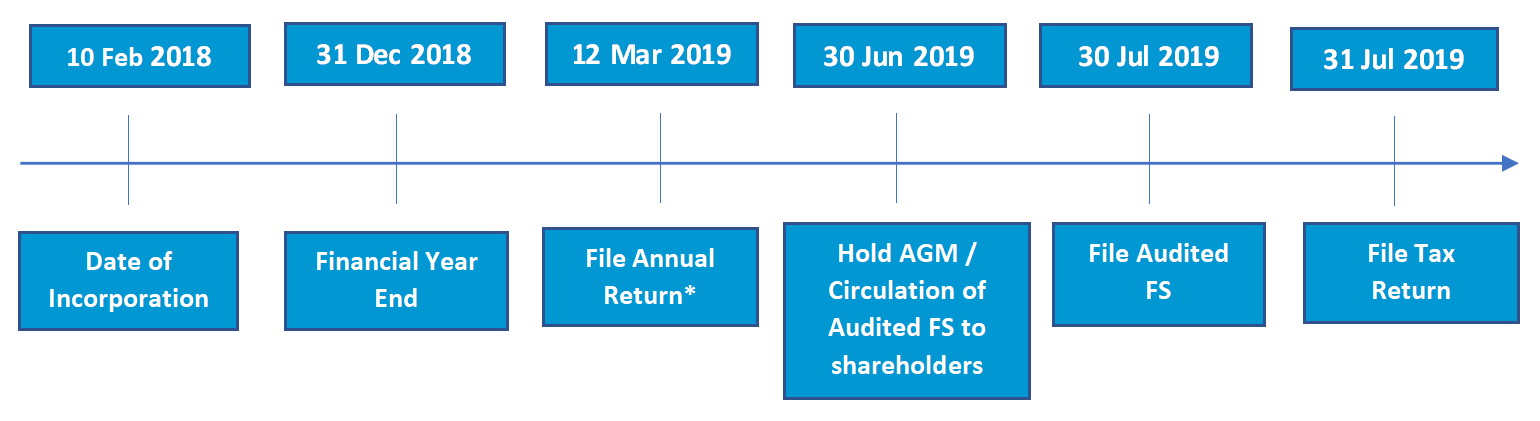

| Yearly compliance requirement |

Example :

|

| Business Structure (minimum requirement) | At least two partners – Individuals (at least 18 years old) or corporate (Company or LLP) |

|---|---|

| Share Capital | N/A |

| Yearly statutory obligation | Annual Declaration of Solvency or Insolvency |

| Business Structure (minimum requirement) | Owner must be Malaysia citizen or permanent resident. |

|---|---|

| Share Capital | N/A |

| Yearly statutory obligation | Yearly renewal of business registration. |

6. What are other compliances requirement in Malaysia that I should know?

TAX RATE

- Sales Tax rate: 5% or 10%

- Service Tax rate: 6% (except for provision of credit card or charge card services, service tax is imposed at RM25 per principle card or supplementary card, annually)

REGISTRATION

- Mandatorily Registration

- Sales Tax:

- Total sales value of taxable goods of a Manufacturer has exceeded RM500,000 within current month and past 11 months period OR is expected to exceed RM500,000 within current month and next 11 months period.

- Wage value/total charges for work performed by Sub-contract Manufacturer has exceeded RM500,000 within past 12 months period (including current month).

- Services Tax:

- Total turnover of taxable services has exceeded RM500,000 within current month and past 11 months period OR is expected to exceed RM500,000 within current month and next 11 months period, except: –

- F&B business – Threshold is RM1,500,000

- Credit Card or Charge Card’s service provider regulated by Bank Negara Malaysia – No Threshold

- Foreign Service Provider (FSP) who provide Digital Services, and the value of digital services provided by them to Malaysian consumers exceeds RM 500,000 within current month and past 11 months period

- Total turnover of taxable services has exceeded RM500,000 within current month and past 11 months period OR is expected to exceed RM500,000 within current month and next 11 months period, except: –

- Sales Tax:

- Exemption from Registration

- Manufacturer of non-taxable goods*;

- Manufacturer or Sub-contractor manufacturer below threshold;

- Manufacturing activities that have been exempted from registration. E.g.:

- Tailoring

- Installation incorporation of goods into building

- Jeweller, optician

* Not eligible for voluntary registration

- Voluntary Registration

- Voluntary registration is allowed provided that the manufacturer is manufacturing taxable goods or the person is doing taxable services.

FILING & PAYMENT OF SST RETURN

- Taxable period: Bimonthly

- Submit SST return and make payment by last day of the following month after the taxable period.

- Dormant companies

- it has been dormant from the time of its incorporation; or

- it is dormant throughout the current financial year and in the immediately preceding financial year.

- Zero-Revenue Companies

- it does not have any revenue during the current financial year;

- it does not have any revenue in the immediate past two financial years; and

- its total assets in the current Statement of Financial Position does not exceed RM300,000 as well as immediate past two financial years.

- Threshold-Qualified Companies

- it has revenue not exceeding RM100,000 during the current financial year and in the immediate past 2 financial years;

- its total assets in the current Statement of Financial Position does not exceed RM300,000 and in the immediate past 2 financial years; and

- it has, at the end of its current financial year and in each of its immediate past two 2 financial years end, not more than 5 employees.

-

- Tax resident : Progressive tax rate of 0% to 30%

- Non-tax resident :

Types of Income Rate (%) - Business, trade or profession

- Employment

- Dividends

- Rents

30 - Public Entertainer

- Interest

15 - Royalty

- Payments for services in connection with the use of property or installation, operation of any plant or machinery purchased from a non-resident

- Payments for technical advice, assistance or services rendered in connection with technical management or administration of any scientific, industrial or commercial undertaking, venture, project or scheme

- Rent or other payments for the use of any movable property

10

*Individual is considered Tax-resident if he/she is in Malaysia for 182 days or more in a calendar year.

Deadline to File Personal Tax Return: –-

- Person not carrying business (generally refer to as employee) – 30 April of the following year

- Person carrying business (sole proprietor or partnership) – 30 June of the following year

- Resident Company with paid-up capital of ≤ RM 2.5 million, gross income from business not ˃ RM 50 million and the Company do not directly or indirectly own by or own a Company having paid up capital of ˃ RM 2.5 million.

First RM 600,000 – 17%

Subsequent Balance – 24%

- Resident Company (Other than Company described above)

- Non-resident Companies

24% - Company originating in the Territory of Labuan and operating a trading activity in this territory

3% of the audited income - Petroleum income tax

38% on income from petroleum operations in Malaysia

25% on income from petroleum operations in marginal fields

*A company is resident in Malaysia if at any time during that basis year the management and control of its business is in Malaysia.

Deadline to File:- Submission of Tax Estimation

- Within 3 months from date of commencement of business (for 1st year of incorporation);

- 30 days before beginning of new financial year (for subsequent years)

- Submission of Tax Estimation

- Corporate Tax Return Filing

- Within 7 months from financial year end

- Malaysian & Permanent Residents (PR)

Age Group < 60 years old ≥ 60 years old (Malaysian) ≥ 60 years old(PR) Monthly wage (RM) ≤ 5,000 ˃ 5,000 No Limit ≤ 5,000 ˃ 5,000 EPF Contribution rate (%) Employer 13 12 4 6.5 6 Employee 11 11 0 5.5 5.5 - Foreigner :

- Have the option to become EPF member.

- If they choose to be member, employer and employee will share the contribution as following: –

Age Group < 60 years old ≥ 60 years old Monthly wage (RM) No Limit EPF Contribution rate (%) Employer RM 5 RM 5 Employee 11% 5.5%

- Malaysian & Permanent Residents (PR)

-

- Malaysian & Permanent Residents (PR)

Category 1st Category 2nd Category Age Group < 60 years old ≥ 60 years old Contribution Scheme Employment Injury Scheme (EIS) & Invalidity Scheme. Employment Injury Scheme (EIS) Contribution Rate (Defer with monthly total wage ceiling, capped at RM 4,000 per month) - Employer: rate from RM 0.40 to RM 69.05

- Employee: rate from RM 0.10 to RM 19.75

- Employer: rate from RM 0.30 to RM 49.40

- Employee: Nil

- Foreigner

- Contribution to the Employment Injury Scheme (EIS) only

- Employer: 1.25% of the employee’s salary and other compensation, capped at RM 4,000.

- Employee: Nil

You could refer to following link for the rate of contribution: – https://www.perkeso.gov.my/index.php/en/social-security-protection/employer-employee-eligibility/rate-of-contributions

- Malaysian & Permanent Residents (PR)

- Business or company which has employees shall register Employer Tax File with Inland Revenue Board Of Malaysia (IRBM).

- Employer has obligation to deduct the MTD from the employee’s monthly remuneration and pay the MTD to the Director General by every 15th day of following month. Employer should make additional deductions from employee’s remuneration in accordance with the direction given by the Director General under Rule 4 of MTD Rules. You could refer to following link for MTD calculator from Inland Revenue Board Malaysia (IRBM) to determine the amount of MTD: http://calcpcb.hasil.gov.my/index.php?&lang=eng

- Employer should register HRDF within 30 days from date of incorporation (compulsory for company falls under the Manufacturing, Services, or Mining & Quarrying sector (based on PSMB Act 2001) and employs ≥ 10 Malaysian employees. HRDF Levy rate is 1% of the monthly wages (basic salary + fixed allowance) of each Malaysian employee.

- Employer who falls under above sectors and employs 5 to 9 Malaysian employees is given option to register. HRDF

Levy rate is 0.5% of the monthly wages (basic salary + fixed allowance) of each Malaysian employee. - You could refer to following link for the full list of industries covered under PSMB Act 2001:

https://www.hrdf.com.my/wp-content/uploads/2016/12/First-Schedule-of-the-PSMB-Act-2001.pdf

-

- Notification of New Employee

- Fill in Form CP22 and submit at nearest assessment branch;

- Within 1 month from the date of commencement of employment.

- Notification of Retirement or Ceased from Employment of Employee

- The employer is responsible for notifying IRBM at least 30 days before the date the employee ceases employment if:

- Employee is about to retire;

- Employee is subject to MTD scheme and the employer has not made any deduction;

- Employee is about to leave Malaysia permanently.

- The employer must withhold money payable to the employee until they receive a Clearance Letter from the Assessment Branch.

- However, the employer is not required to send notification about the employee ceasing employment or withhold money payable to him if:

- Employee is subject to MTD and deduction has been made by the employer;

- Employee’s remuneration is less than the minimum income subject to MTD;

- Employer is aware that the employee is to be employed elsewhere in Malaysia.

- Form to be used:

- CP22A – Notification of cessation of employment (Employment of Private Sector Employees)

- CP22B – Notification of cessation of employment (Employment of Public Sector Employees)

- The employer is responsible for notifying IRBM at least 30 days before the date the employee ceases employment if:

- Yearly Remuneration Statement (EA/EC Forms)

Every employer shall, prepare and render to his employee, a statement of remuneration of that employee for each year, on or before the last day of February in the following year.

Forms to be used:

- EA – Remuneration Statement for Private Employees.

- EC – Remuneration Statement for Government Employees.

- Notification of New Employee